Crossing the border into Mexico with cash for something like a medical procedure or dental work is common. But what if someone doesn’t file a FinCEN Form 105 (PDF version & Online version)? Can US Customs can seize their cash, checks or pesos?

First, we need to know what the form is about. FinCEN (Financial Crimes Enforcement Network) is a division of the United States Department of the Treasury that collects information about financial transactions to combat money laundering, terrorist financing, and other financial crimes.

Cash seizures at the border with Mexico doesn’t mean Customs thinks you are a criminal. In fact, FinCEN doesn’t directly handle these money seizure cases, however, they provide guidance and support to other law enforcement agencies, such as Customs and Border Protection (CBP), which is responsible for enforcing laws and regulations related to cash and monetary instruments. They give the CBP officers the right to take your currency, no matter what form, and try to tell you that you are up to no good and therefore, they are seizing your cash.

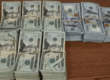

When CBP officers encounter individuals attempting to cross the U.S. border with large amounts of cash (generally $10,000 or more), they may seize the funds if they have reasonable suspicion that the money is linked to criminal activity or is being transported without the FinCEN form. Customs can bring a dog over to alert on the money because virtually all US currency has touched enough drugs for a canine to alert.

People, like you, are required to fill out a FinCEN Form 105, also known as the Report of International Transportation of Currency or Monetary Instruments (CMIR), when they are carrying currency or monetary instruments in amounts of $10,000 or more into or out of the United States. This applies to both U.S. citizens and non-citizens. Oftentimes, American citizens traveling to Mexico with large sums of cash, including funds intended for medical or surgical procedures like a tummy tuck, don’t fill out the FinCEN Form 105 and end up cancelling the procedure after their money is seized. It is not a feeling anyone wants.

Once seized, CBP or US Customs typically initiates administrative forfeiture proceedings to start legal procedures for confiscating and keeping all the seized cash, currency or checks. People, like you, whose cash has been seized have the right to challenge the seizure through the administrative forfeiture process or by choosing one of the four “election of proceedings” explained poorly in a letter they receive. The question becomes which election will work and which election stands the best chance of returning the money as quick as possible.

San Diego Defenders Forfeiture Law Firm can assist in these complex asset seizure matters. We do not take forfeiture cases that we think we cannot win, which is supported by our track record and reputation within this specialized legal field. Read the reviews our clients submitted. We are a small, but well known office by US Customs and CBP and believe we can assist in getting most clients’ assets, that is money, returned.

Contact us and allow us to explain how our team can make your experience stress free. We are a law firm with the experience and reputation to help you. Call us at (619) 258-8888 for a free and confidential consultation. Our paralegal specialists speak Spanish and payment plans are available. Call us today.