I am an asset forfeiture and criminal defense lawyer. I get calls every week from perfect law-abiding citizens about their cash getting seized by US Postal Service or at airports.//borders Just this week a veterinarian called me from out of state to tell me she had mailed cash or “US Currency” and it became lost or missing. Why cash you say? Many good reasons. I have mailed my sister cash because her bank was charging her all kinds of fees and she had a relatively small tax lien, so she could not cash a check to fix her car to go to work without losing the money. So I mailed her cash and that is perfectly legal and will solve the problem unless the envelope goes through an x-ray scanner and it gets flagged as suspicious and seized by one of the “ABC’s” such as USPIS, DEA, FBI, CBP, IRS, HSI, ICE and then it will take some work to get it back. But let’s get back to my large animal veterinarian that called me last week.

She is a law-abiding citizen. She sent cash to a friend that was going to coordinate getting financial help to a friend stuck in a foreign country where “mordida” bribes are the norm to grease the wheels for visas, travel within that country and everything from hotel stays to VAT or value-added taxes on any item necessary to survive until you can get out of that country. In this case, the doctor tracked the shipment mail to the mutual friend in the U. S. and it appeared stuck in Chicago. She called the USPS lost and found department only to get misleading answers. The doctor called me after receiving a threatening letter from the Postal Inspector aka USPIS that reads “NOTICE OF SEIZURE AND INITIATION OF ADMINISTRATIVE FORFEITURE PROCEEDINGS” … “Seized Property Identifying Information” which then sets forth the description of the seized property as $20,000.00 US Currency. The Dr. asked me “Is it against the law to mail cash?” No, I said, I have done the same. And I cannot emphasize it enough! No.

WHAT LAW ALLOWS THE GOVERNMENT TO TAKE MY MONEY?

I explained it is not against the law to mail cash currency, however, the United States through its numerous agencies (you will find listed on www.forfeiture.gov) will cite many laws for forfeiture authority under 21 USC 881 and 19 USC § 983 and 19 USC 1602-1619 and finally cite 39 C.F.R. 233.7 (CFR which stands for Code of Federal Regulation and USC is United States Code.) And understanding these confusing laws and their origins under old English laws – like The Sugar Act of 1764 by King George II https://avalon.law.yale.edu/18th_century/sugar_act_1764.asp, that arguably fueled the American Revolution – is damn near impossible for most people to comprehend. It takes years for most lawyers to get really good at fighting asset forfeiture by a very aggressive Government!

CAN’T I JUST EXPLAIN AND GET IT BACK MYSELF OR DO I NEED A LAWYER?

Yet, when you read the notice of seizure letter or go to the FAQ’s https://www.forfeiture.gov/FilingClaimFAQs.htm website, the Government will assure you that you “don’t need a lawyer” but you must sign the claim for your lawyer to file a claim. To me, it is kind your GMC auto manual stating “you don’t need a mechanic to fix your brakes, you can DIY “do it yourself.” And at the bottom of the page should be “Note, make sure your defective airbags are working properly” before you pump your brake pedal going down the steep hill with a turn at the bottom while on the way home with your kids in your SUV. Great advice from the GMC employee on repairing your SUV brakes as long as it is not the GMC’s employee or their children in the SUV speeding through the woods down the steep hill with a turn at the bottom of the grade! You may not need a mechanic to repair, but you will need a doctor and a lawyer if the brakes fail!

NOTICE “YOU DON’T NEED A LAWYER- PENALTIES FOR FRIVOLOUS CLAIMS ”

The sadly laughable part about the notice from the USPIS – Asset Forfeiture Unit is that they send you a two-page letter that points you to www.forfeiture.gov/FilingPetitionFAQs.htm and other pages within its massive site only to assure you on page 2 II. (F) No Attorney Required. “You don’t need an attorney to file a claim. You may, however, hire an attorney to represent you in filing a claim.” And this sage advice is one small paragraph away from “H. Penalties for Filing a False or Frivolous Claims:” So, if you make a mistake, The Government threatens that you may pay the price!

Sound familiar? How many times have we seen a TV show where the accused asks “Do I need a lawyer?” And the interrogating officer always seems to smile and assure the accused that they don’t if they are innocent. Rarely do you hear the reply “Anything you say can and will be used against you in a court of law.” Only to find the report is nothing like the statement you gave! So much for advice from the Government “trust us, you do not have to retain a lawyer, but…..”

LAW FIRMS CHARGE A FLAT FEE OR A CONTINGENCY FEE ON SOME CASES

Seriously, it has taken 30 years to learn the ins and outs of forfeiture and seizure law. There is the administrative petition, offer in compromise, abandon, court action, take no action, release on payment, holder of the lien or security interest, offer in compromise and claim. All of these choices are followed by USC code sections, CFR regulations all contained in, in many cases, the “Election of Proceedings.” Now, who would need a lawyer to figure all that out?

We have all heard the expression “I Don’t Trust the Government” and it has been around a long time. Given the fact that the Government seizes and forfeits around 2.6 Billion in assets from many innocent people like you and me every year, maybe you should hire a lawyer. What do you have to lose? The Government already has your cash, vehicle or property and they do not want to make it easy to get it back! I encourage you to go to www.forfeiture.gov and check it out before you call a lawyer that really knows asset seizure and forfeiture law.

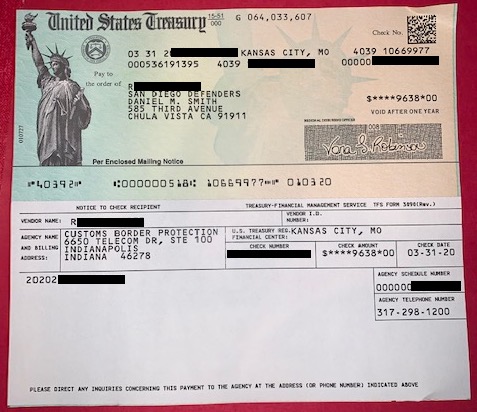

By Daniel Smith, San Diego Defenders, APC. (619) 258.8888