How Can a CBX Cash Seizure Attorney Help Me Get My Money Back From CBP?

If your money has recently been seized while traveling between San Diego and the Tijuana Airport through the Cross Border Xpress, a CBX cash seizure attorney can help get your property returned.

Call San Diego Defenders – Forfeiture Law Firm at (619) 258-8888 for a free, confidential consultation.

This is a confusing and stressful experience, and you likely have a lot of questions.

San Diego Defenders – Forfeiture Law Firm has over 60 years combined experience and will take care of all paperwork, calls, and negotiations from beginning of the process all the way to picking up your property. We offer free consultations.

Every year, travelers are stopped at the Cross Border Xpress (CBX) and have thousands of dollars taken by U.S. Customs and Border Protection (CBP).

Per Smart Border Coalition, 2,285,000 total pedestrians were using the CBX just in FY2024 alone, which is 6,300 travelers per day.

Most are unaware that carrying over $10,000 in currency when traveling internationally requires completing the FinCEN Form 105, and failure to file the proper paperwork can result in the entire amount being seized.

Our law firm represents clients facing currency and other property seizures at CBX, Otay Mesa, and other San Diego border crossings.

San Diego Defenders – Forfeiture Law Firm is experienced in handling federal asset forfeiture cases and can help you recover your money. Check our recent results here.

Why Was My Money Seized at the Border?

As a CBX cash seizure attorney, our firm frequently hears from travelers surprised to learn that carrying large amounts of cash is legal.

U.S. law under 31 U.S.C. § 5316 requires that anyone bringing in or taking out over $10,000 in cash or monetary instruments must report it using the proper form.

If you fail to report, file incorrectly, intentionally conceal cash, or divide cash among multiple travelers to avoid detection, CBP may seize the money under 31 U.S.C. § 5317(c)(2), § 5332(a), or § 5324(c).

CBP officers at the CBX are trained to detect undeclared currency and investigate for signs of bulk cash smuggling or structuring.

Even travelers with lawful money and good intentions can find themselves facing forfeiture proceedings.

What Is the FinCEN Form 105?

The FinCEN Form 105 is a declaration form required when transporting more than $10,000 across the U.S. borders.

Customs agents will count family members’ currency together, even though each person is carrying under $10,000.

As a CBX cash seizure attorney, our firm often helps clients who were never informed about this requirement or who believed dividing cash between travel companions avoided the need to file.

Click here to learn more about CBP Cash Seizures after failing to file a FinCEN Form 105.

fin105_cmir(2)The Role of the FMM Form

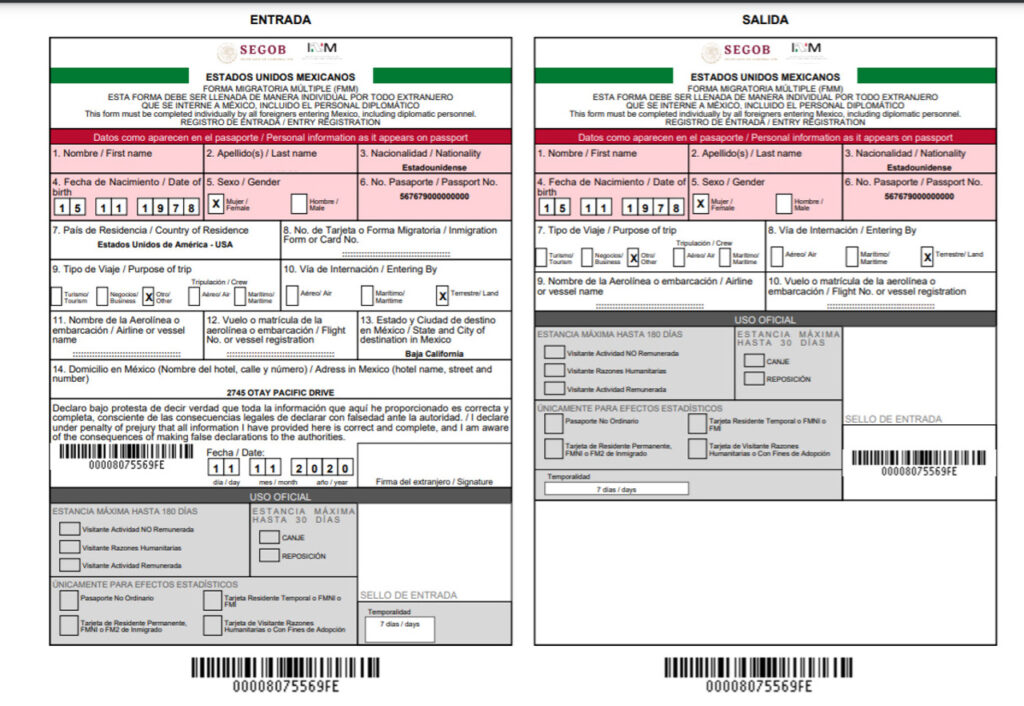

Travelers entering Mexico through the Cross Border Xpress must also fill out the FMM (Forma Migratoria Múltiple).

You can either fill the FMM out in the San Diego terminal at the machines on the CBX counters and print it, or you can fill it out beforehand online.

The FMM form is presented to Mexican Immigration Officials upon entering and exiting the Tijuana Airport through the CBX bridge.

The form does not have a field to declare any money you are traveling with; it instead asks for your basic passenger information, the purpose of your trip, where you are staying, and flight information.

However, if the details in your FMM do not match your stated purpose of travel or if CBP perceives any inconsistency, you may be subject to increased scrutiny when returning to the United States, which could ultimately result in your cash being seized.

We help clients clarify these misunderstandings and correct the record with CBP when handling their cash seizure case.

Successful Case Result: Full Return of Funds Seized at CBX

Our previous client, a licensed medical professional who resides and works in Mexico, had over $12,190 in U.S. currency and 23,920 in Mexican Pesos seized by CBP at the Otay Cross Border Xpress.

Like many others, they were planning to vacation in San Diego for the New Year with family, had lawfully earned the money, and answered Customs’ questions truthfully.

Unfortunately, the client was unaware of the FinCEN 105 requirement and had divided the money with their partner for safety reasons while traveling.

CBP seized the funds under 31 U.S.C. § 5317(c)(2), § 5332(a), § 5324(c), and § 5326(a)(1)(B), citing alleged structuring, bulk cash smuggling, and failure to report.

There was no evidence of criminal activity, and Attorney Dan Smith demonstrated the source of the money with complete documentation of tax returns.

As the client’s CBX cash seizure attorney, we filed a claim showing that the funds were legitimate, the client had no intent to violate the law, and that any failure to file was a misunderstanding.

Ultimately, we recovered the full amount of the seized funds, both U.S. dollars and pesos.

Electing to file a claim ensures that the matter is negotiated attorney-to-attorney promptly, as there is a 90-day litigation period.

With offers in compromise and petitions, two other options on the Election of Proceedings form, there is no set time limit for CBP officers to respond; therefore, your case could sit on their desk for months without a response.

What to Expect After a CBX Cash Seizure

Once CBP seizes your money, they issue a Custody Receipt (CBP Form 6051S).

If the Election of Proceedings and Notice of Seizure and Information to Claimants forms are not generated on site, they are sent to the property owner(s) by certified mail in 3-4 weeks following seizure.

Election of Proceedings — CAFRA Form Notice of Seizure and Information to Claimants CAFRA FormHowever, CBP can take 30-60 days after seizure to send these forms out.

You typically have 30 days to respond with a claim or petition. Failure to act in time may result in permanent forfeiture and total loss of your property.

Call us at (619) 258-8888, and we will evaluate your situation.

As a seasoned CBX cash seizure attorney, our firm helps clients file petitions for remission or mitigation, demand judicial forfeiture when needed, and negotiate favorable outcomes with CBP.

Every case is different, and we’ll tailor a strategy that fits your facts and goals.

Why Hire a CBX Cash Seizure Attorney?

Having an experienced CBX cash seizure attorney gives you a critical advantage.

We understand CBP’s procedures and the federal laws they rely on.

Our firm has successfully handled seizures at CBX and other border crossings and knows how to prove lawful ownership, resolve reporting errors, and challenge overreaching government actions.

We provide fast response times, bilingual English-Spanish service, and flat-fee pricing so you know exactly what to expect.

Contact San Diego Defenders – Forfeiture Law Firm – Don’t Let CBP Keep Your Money

If your money was seized at the CBX, don’t wait.

You have a limited window to take legal action. Our office is ready to fight for the return of your funds and protect your rights.

Call us today at (619) 258-8888 for a free, confidential consultation with a trusted CBX cash seizure attorney.

Although we are based in Chula Vista, California, we help clients nationwide in New York, Arizona, Texas, Vermont, Michigan, Washington, and the other 50 states!